Last week I spent the day at #Accountex2014. If you haven’t been before, it’s a massive room filled with exhibitions by those who supply services to accountants, along with regular keynote speakers, mini seminars, and of course free stuff everywhere (like the little mini ice cream cones handed out by @Xero).

Gary Turner is the UK Managing Director of Xero, and his keynote for accountants was absolutely spot on. We’re huge fans of Xero, using it ourselves not only in the Profitable Firm but in our parent company, BGCN. It sounds cheesy I know, but we truly have tried the rest and found Xero to be the best.

Gary’s talk was full of the kind of thing we are constantly sharing with accountants, hoping to educate you about the fact that the cloud is not this new thing, a revolution, a change in the way we do business. The cloud is here. The revolution has happened. And the way we do business has changed – it’s just a matter of determining whether your accountancy firm is fully on board with that or not.

Here are a few thoughts on cloud accounting, courtesy of Gary, and agreed to entirely by me!

Desktop software is out, and mobile is in.

You’re not getting emerging new IT companies that are using old-school software, the kind you download, and put on your computer or server. Online collaboration and mobile apps are what the world uses.

The internet is 25 years old.

“You used to have to phone the internet, and no one could use the phone while you were using the internet.” Now, wifi is a basic human right, something we look for the second we arrive at a coffee shop, an airport, even a library – and when visiting someone else’s home.

IT jobs are only on the increase.

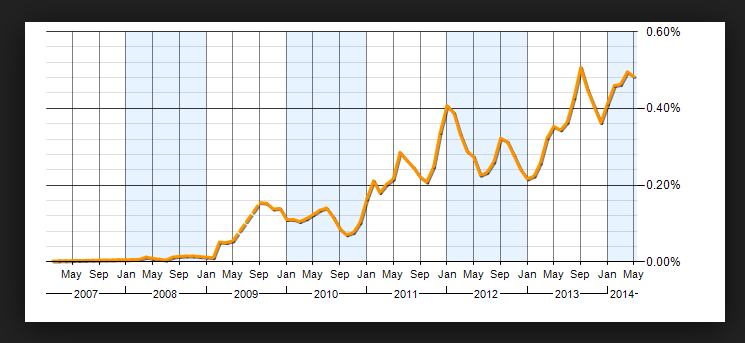

Check out this cool graph about IT jobs in the UK, and if that doesn’t show you what’s happening in the industry, I don’t know what does.

The most popular accounting software is an Excel spreadsheet.

Over 40% of first-time Xero users are not switching from another software, they’re jotting down numbers on their computer and then thinking, “There has to be a simpler way to do this”.

IT overheads are gone.

Software often was found to be too expensive, too confusing, or businesses didn’t have the time or expertise to implement it. There were huge overheads in making software work. The days of downloading, learning, upgrading, backing up, restoring, addressing new versions, meant that “we all had to be IT managers just to use a PC”. No more – simplicity is in. We’re not hiring IT managers or even signing up to IT contracts – we’re outsourcing bits and pieces of it to various suppliers.

It’s no longer “whether” you will be in the cloud.

Even a few years ago, adopting online accounting solutions (or online anything) was an option for accountants to consider. Now, being able to update accounts on a phone, in an airport on the way out of town, is more of a basic client right. “The change to PC’s was not a revolution – it was a preamble. This IS the revolution.”

Other accountants are changing their mind.

In the past six months, 10% more accountants in the UK went from “I will not be adopting cloud accounting” to “I am definitely going to adopt cloud accounting”. That is a massive shift – and it’s super fast. You can’t get on the bandwagon because it’s already gone, but you can certainly stay six months ahead of the other accountants in your area.

Collaboration is in, cut-throat management is out.

I’m writing a book review on Peter Shankman’s “Nice Companies Finish First: Why Cutthroat Management is Out, and Collaboration Is In” – more on that later.

Advisory work is suddenly possible and profitable.

I worked for years with an organisation that provided small business consulting tools to accountants, to help them deliver advisory work. The one sticking point for many accountants was always, “How do I get my clients to realise they need more than just their accounts?” The answer is here, in online accounting, in apps like Xero. If your clients are getting and reviewing and tracking their accounts on a daily basis, they realise their need for the softer services – management account meetings, board meetings, cash flow forecasts, budgeting support. Which means your selling is done for you – by your clients themselves.

Because of all this….

1. You can’t dabble.

I love that Gary said this – I’m writing a whole post on “Dominate, Don’t Dabble”….more later….

2. Really commit.

A quote from a Xero user: “This is not an add-on, it’s an integral part of your accounting firm.” (Paul Bulpitt, the WOW Company)

3. Prioritise the mobile version of your website.

Over 60% of your prospects are viewing your website on a smartphone or tablet. What do they see? Is it easy to navigate? You’ve got less than 2 seconds before they get bored or annoyed and try another firm’s website. Gary suggested that an easy action to take is to get a mobile-responsive version of your site – talk to us about this.

4. Address your SEO.

“The best place to hide a body is on page two of Google search results.” If this is true (and it is), you’ve got to make sure your firm is showing up on page one. Buying some Google ads and writing regular blog content is critical.

5. Train your team on all things cloud.

Your firm should be “digital by default” – which as Paul said, it’s not just about signing up for Xero. It’s about training your team and optimising your processes for the new digital world.

6. Use Xero University.

I met with a few of the Xero UK marketing team, and what they’re making available for accountants in the near future is really brilliant. The Profitable Firm will be speaking on several webinars during Xero’s online Summer Camp, so get connected with that now.